What is Bitcoin Halving?

Bitcoin Halving is a significant event in the world of cryptocurrency, and understanding its implications is crucial for investors and enthusiasts alike. The process of Bitcoin Halving involves reducing the block reward given to miners by half, occurring approximately every four years. This reduction in rewards has a direct impact on the supply of new Bitcoins entering the market and can influence its price dynamics. In the past, Bitcoin Halving events have led to increased demand and subsequent price surges. As we approach Bitcoin Halving 2024, experts predict that it will further drive up prices and attract more attention from both retail and institutional investors. Taking these predictions into account, developing informed investment strategies becomes vital to maximize potential gains while minimizing risks associated with this highly anticipated event.

Explanation of Bitcoin Halving

Bitcoin Halving is a process that involves reducing the block reward given to miners by half, occurring approximately every four years. This reduction in rewards directly impacts the supply of new Bitcoins entering the market and can influence its price dynamics. During Bitcoin Halving events, demand typically increases, leading to price surges. Understanding this process is crucial for investors, as it allows them to anticipate potential market movements and adjust their strategies accordingly. By staying informed about past halving events and expert forecasts for Bitcoin Halving 2024, investors can make more informed decisions and potentially maximize their gains while mitigating risks associated with this anticipated event. It’s essential to develop appropriate investment strategies that align with one’s risk tolerance and financial goals.

Implications of Bitcoin Halving on the cryptocurrency market

Bitcoin Halving has significant implications on the cryptocurrency market, particularly in terms of supply and demand dynamics. As the block rewards for miners decrease, the rate at which new Bitcoins are added to circulation slows down. This scarcity can lead to increased demand and potentially drive up the price of Bitcoin. In the past, halving events have been followed by bull markets, where Bitcoin’s value skyrocketed. However, it’s important for investors to exercise caution and consider other factors that may affect the market post-halving. By staying informed about expert forecasts and market trends, investors can make strategic decisions to optimize their gains during this anticipated event.

History of Bitcoin Halving

Bitcoin Halving, also known as the “Halvening,” is a significant event in the history of Bitcoin. It occurs approximately every four years and serves to reduce the reward that miners receive for validating transactions on the network. The purpose of this event is to control the supply of new bitcoins entering circulation and effectively manage inflation.

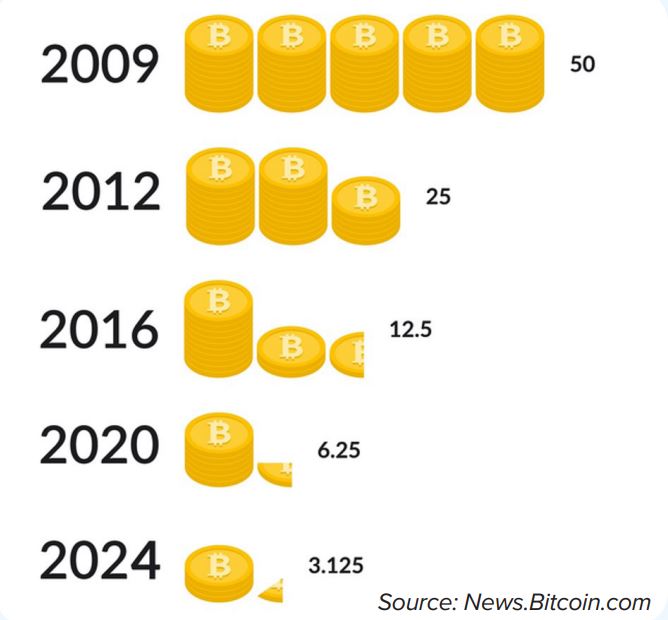

The first Bitcoin Halving took place in 2012 when block rewards were reduced from 50 BTC to 25 BTC. This was followed by another halving in 2016, which further reduced block rewards to 12.5 BTC. These events marked important milestones in Bitcoin’s history and had a profound impact on its price and mining ecosystem.

With each halving, the rate at which new bitcoins are created slows down, increasing scarcity over time. This has historically led to an increase in demand for Bitcoin as investors anticipate future price appreciation due to limited supply.

Following the previous two halvings, Bitcoin experienced significant price rallies, reaching all-time highs shortly after these events. For example, after the 2012 halving, Bitcoin’s price surged from around $12 to over $260 within six months. Similarly, after the 2016 halving, Bitcoin’s price skyrocketed from around $660 to nearly $20,000 in late 2017.

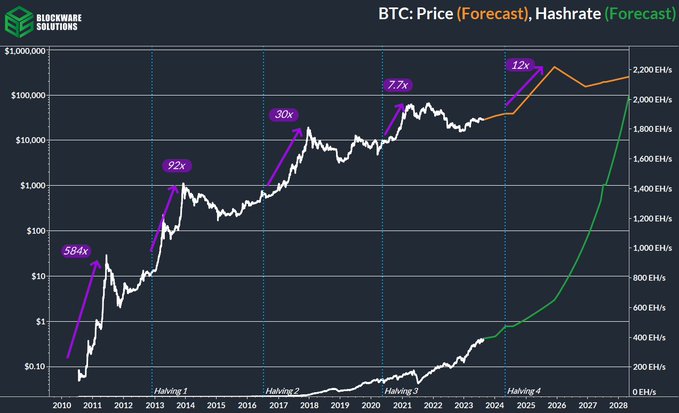

These historical patterns have generated excitement and speculation about what will happen during the next halving event scheduled for 2024. Expert forecasts suggest that we may witness another bull market as investors continue to recognize Bitcoin’s potential as a store of value and hedge against traditional financial systems’ vulnerabilities.

Overview of past Bitcoin Halving events

Throughout Bitcoin’s history, there have been two significant halvings. The first one occurred in 2012, reducing block rewards from 50 BTC to 25 BTC. This event demonstrated the protocol’s ability to control inflation and manage the supply of new coins. Fast forward to 2016, and the second halving took place, further reducing block rewards to 12.5 BTC. These events had a noticeable impact on Bitcoin’s price and mining ecosystem, leading to significant price rallies shortly after each halving. Traders and investors reacted positively as scarcity increased due to the reduced rate of coin creation. This historical pattern sets the stage for excitement and anticipation ahead of the next halving event scheduled for 2024.

Impact of Bitcoin Halving on Bitcoin’s price and mining

The previous Bitcoin halving events had a significant impact on both Bitcoin’s price and the mining ecosystem. Following each halving, there was a notable increase in Bitcoin’s price due to the scarcity created by the reduced rate of coin creation. Traders and investors reacted positively to this increased scarcity, leading to significant price rallies. Additionally, mining became more competitive as miners received fewer rewards per block mined. This increase in competition led to advancements in mining technology and tactics to maintain profitability. Understanding these past impacts helps anticipate potential outcomes for the next halving event in 2024.

Bitcoin Halving 2024 Prediction

Bitcoin Halving 2024 Prediction: Expert forecasts on the potential outcomes of Bitcoin Halving

Expert forecasts suggest that the next Bitcoin halving event in 2024 could have a similar impact on the cryptocurrency market as previous halvings. Bitcoin’s price is expected to experience significant increases due to reduced coin supply, leading to increased demand from investors. Mining operations are likely to become even more competitive, driving advances in technology and strategies. However, it’s essential for investors to consider various factors that could influence the future of Bitcoin post-halving, such as regulatory developments and adoption rates. Developing well-informed investment strategies and employing risk management techniques will be crucial for navigating the market around the halving event.

Expert forecasts suggest that the next Bitcoin halving event in 2024 could have a similar impact on the cryptocurrency market as previous halvings.

Factors influencing the future of Bitcoin post-halving

Factors influencing the future of Bitcoin post-halving include market demand, regulatory developments, and technological advancements. As the supply of new Bitcoins decreases after each halving event, the scarcity of the cryptocurrency may drive up its value. Additionally, regulatory decisions by governments around the world can impact Bitcoin’s adoption and acceptance as a mainstream financial asset. Technological advancements such as the implementation of scalability solutions and improvements in security can also shape Bitcoin’s future trajectory. Investors should stay informed about these factors to make well-informed decisions and capitalize on potential opportunities in the cryptocurrency market post-halving.

Bitcoin Mining and Rewards

Bitcoin Mining and Rewards play a crucial role in the functioning of the Bitcoin network. Through mining, new Bitcoins are created and transactions are verified, ensuring the integrity of the blockchain. After each halving event, the block rewards received by miners are reduced by half. In 2024, this will result in miners receiving 3.125 Bitcoins per block mined, compared to 6.25 Bitcoins currently. Miners need to adapt their strategies and optimize their operations to maintain profitability post-halving. They may need to invest in more efficient hardware or join mining pools to increase their chances of earning rewards. Additionally, transaction fees become even more important as they contribute significantly to a miner’s revenue after the block reward reduction.

Explanation of Bitcoin mining process

Bitcoin mining is the process through which new Bitcoins are created and transactions are verified. Miners use powerful computers to solve complex mathematical problems, adding new blocks to the blockchain. This ensures the security and integrity of the Bitcoin network. During the mining process, miners compete to be the first to find a valid solution and receive a block reward, which consists of newly minted Bitcoins. Mining also plays a crucial role in confirming transactions, preventing double spending, and maintaining consensus within the network. Miners validate and verify transactions by solving these mathematical problems, contributing to the decentralized nature of Bitcoin. The mining process requires significant computational power and energy consumption, prompting some miners to establish large-scale operations for optimal efficiency and profitability. By ensuring transaction integrity, miners play an essential role in the functioning of the bitcoin ecosystem.

Changes in block rewards post Bitcoin Halving 2024

After the Bitcoin Halving in 2024, there will be a significant change in block rewards. The block reward refers to the number of Bitcoins that miners receive for successfully adding a new block to the blockchain. Currently, miners are rewarded with 6.25 Bitcoins per block. However, after the halving event, this reward will be reduced by half to 3.125 Bitcoins per block. This reduction in block rewards has several implications for the cryptocurrency market and mining industry. Miners will need to recalibrate their operations to ensure profitability and sustainability amidst lower rewards. Additionally, it may increase competition among miners and encourage more efficient mining practices to maintain profitability in the post-halving era.

Investor Strategies for Bitcoin Halving

Investor Strategies for Bitcoin Halving:

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies and other assets to mitigate risks associated with the volatility of Bitcoin during the halving event.

- Stay Informed: Stay updated on market trends, news, and expert opinions to make informed investment decisions.

- Set Realistic Expectations: Understand that price fluctuations are expected before and after the halving, so avoid making impulsive decisions based on short-term price movements.

- Risk Management: Implement risk management techniques such as setting stop-loss orders and taking profits at strategic points to protect your investment capital.

- Long-Term Perspective: Consider a long-term investment strategy as Bitcoin’s value has historically increased over time despite short-term fluctuations.

Remember, research thoroughly and consult with financial experts before making any investment decisions related to Bitcoin Halving 2024.

Tips for investors to navigate the market during Bitcoin Halving

During Bitcoin halving, investors should focus on strategies to navigate the market effectively. Here are some tips to consider:

- Stay Informed: Keep up with market trends and news to make informed investment decisions.

- Diversify Your Portfolio: Spread your investments across various cryptocurrencies and assets to minimize risks associated with Bitcoin’s volatility.

- Set Realistic Expectations: Understand that price fluctuations are normal before and after halving, so avoid making impulsive decisions based on short-term movements.

- Implement Risk Management Techniques: Use stop-loss orders and take profits at strategic points to protect your capital from significant losses.

- Consider a Long-term Approach: Bitcoin’s value has historically increased over time, so maintaining a long-term investment perspective can yield positive results despite short-term fluctuations.

By following these tips, investors can navigate the Bitcoin halving event more confidently while minimizing potential risks.

Risk management techniques for trading Bitcoin around the halving event

Investors need to employ effective risk management techniques when trading Bitcoin around the halving event. Here are some actionable steps they can take:

- Set a clear stop-loss order to limit potential losses.

- Use take-profit orders to secure profits at strategic points.

- Diversify their portfolio by investing in other cryptocurrencies or assets.

- Stay informed about market trends and news that may impact Bitcoin’s price.

- Avoid making impulsive decisions based on short-term price fluctuations.

By implementing these risk management strategies, investors can navigate the volatile market during the halving event with greater confidence and minimize potential risks.

Conclusion

Investors need to employ effective risk management techniques when trading Bitcoin around the halving event. Here are some actionable steps they can take:

- Set a clear stop-loss order to limit potential losses.

- Use take-profit orders to secure profits at strategic points.

- Diversify their portfolio by investing in other cryptocurrencies or assets.

- Stay informed about market trends and news that may impact Bitcoin’s price.

- Avoid making impulsive decisions based on short-term price fluctuations.

By implementing these risk management strategies, investors can navigate the volatile market during the halving event with greater confidence and minimize potential risks.

In conclusion, understanding the significance of Bitcoin halving 2024 is crucial for investors to make informed decisions and manage their risks effectively in the cryptocurrency market.

Summary of Bitcoin Halving 2024 significance

The significance of Bitcoin Halving 2024 lies in its impact on the cryptocurrency market and mining rewards. As the block rewards are reduced, it creates scarcity and potentially drives up the price of Bitcoin.

Investors can take proactive steps to navigate this event by setting clear stop-loss orders, using take-profit orders, diversifying their portfolio, staying informed about market trends, and avoiding impulsive decisions. These risk management techniques will help them mitigate potential losses and make informed trading decisions.

Understanding the significance of Bitcoin Halving 2024 is crucial for investors to effectively manage their risks and capitalize on potential opportunities in the cryptocurrency market. By implementing these strategies, they can confidently navigate the volatile market dynamics surrounding the halving event.

MB Miners

MB Miners